Strapped for Cash? You Can Still Build Great Money Habits

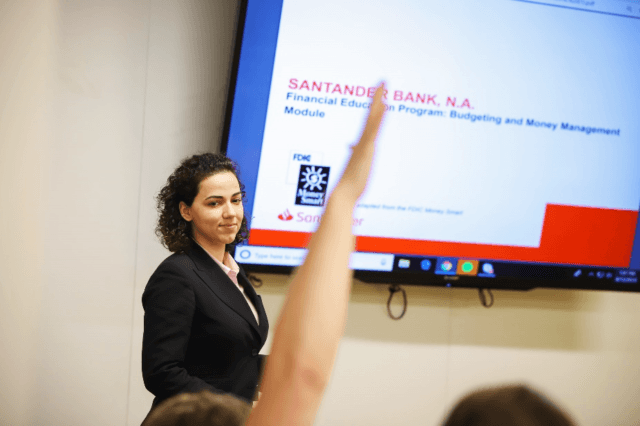

Veriko Gagnashvili, internal auditor for Santander Bank, conducts a financial education session on budgeting and money management for City Year AmeriCorps members in Boston.

Even when you’re strapped for cash, you can still develop good money habits that will pay off for a lifetime—just ask a fellow City Year AmeriCorps member.

“I’m not a good saver. And I tell myself, `I’m not making that much, so do I have anything to save?’’’ says Joshua Croom, who tutors and mentors eighth graders at a City Year partner school in Boston. “I forget how a small reduction in spending or taking a small portion of what you’re making and setting it aside is really important.’’

Tracking expenses is key to meeting short-term goals, like saving for a trip, and to laying the groundwork for future plans like home ownership, says Joshua, who’s educating himself about finances with the help of Santander Bank. Santander sponsors his City Year team and also holds financial literacy sessions with corps members that cover creating a budget and managing credit and debt.

April is Financial Literacy Month, making it a great time to learn more about handling your money and how to stretch your paycheck.

Lindsey Clark, community partnerships manager for Santander Bank, with City Year AmeriCorps member Joshua Croom and teammates.

Lindsey Clark, community partnerships manager for Santander Bank, with City Year AmeriCorps member Joshua Croom and teammates.

Getting into the routine in your twenties of socking away even a small amount of money on a regular basis—and being mindful of your spending—will pay off in the long run, says Seth Goodall, Executive Director of Corporate Social Responsibility at Santander Bank. Santander is a City Year National Partner that sponsors five teams nationwide of AmeriCorps members who tutor and mentor students to help them reach their potential at school and beyond.

Educating yourself about money early on creates a foundation for financial health as your career progresses and your earnings rise.

“Being wise about money is about being proactive as well as about listening to advice, because the old adage, `It’s not how much you earn, it’s how much you save,’ is so true,’’ says Seth, who wishes he’d made fewer impulse purchases in his twenties. “Early on, whether in high school or at your first job out of college, it’s critical to learn to plan for milestones in your life—such as buying your first car, or a home or even preparing for retirement.”

Joshua has looked for financial ideas from a friend who is a landlord who told him about the benefits of home ownership as a way to earn additional income. From talking to Santander employees who have given AmeriCorps members financial tips, he’s also learned about how to earn a good credit score—including by not spending up to the entire limit on your credit cards.

Some advice from Joshua on how to stick to a budget:

- Cook at home—you avoid the expense of eating out. Inviting friends over for potluck meals or watching Netflix are fun ways to socialize.

- Take advantage of free events by scoping out museums, community spaces and colleges nearby.

- Look into the benefits you might get as a corps member—Joshua rides public trains for free!

Related stories

A moment that captures the advent of certainty in my career choice occurred to me recently. My student marched into...

Read more about My Life After City YearThe decision to come back for a second City Year is always a big one. Devoting even one year of...

Read more about Transferring Sites: From Ohio to BostonThis year marks the 9th edition of Spring into Service, and we could not be more excited to see the...

Read more about Spring Into Service with CYGB!This year, City Year Greater Boston expanded its annual MLK Day of Service to a full week of service, honoring...

Read more about MLK Week of Service Recap!